GoodTech Information Systems Inc., a homegrown sustainable financial technology company, has formalized its partnership with clients and key technology vendors to boost access to financial services in rural communities.

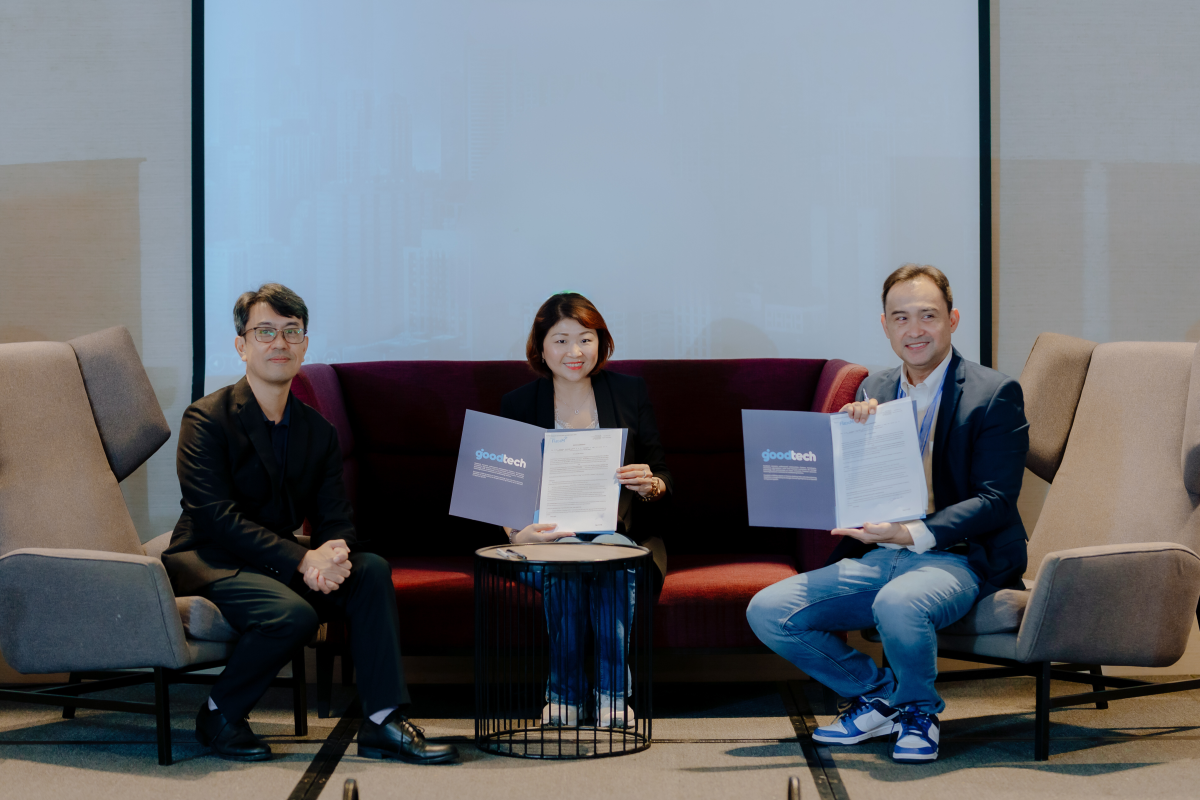

At the GoodTech Summit last June 5 in Bacolod, GoodTech held a commitment ceremony with Banco Santiago de Libon and Las Piñas TODA Cooperatives so they can tap GoodLoan, a cutting–edge application to digitalize and enhance their lending businesses.

Likewise, GoodTech teamed up with technology firms FlexM for fraud monitoring, Boost for chat–based loan origination, Mindigital for digital consumer lending, Loxon for collection technology, Senangdali for loan protection insurance, and SunSmart for renewable energy financing—all to expand its suite of product offerings.

“The signing ceremony by both partners and clients demonstrates the strong confidence that our stakeholders have on GoodTech. We are the reliable partner for technology implementation that addresses key bank pain points,” GoodTech Cofounder Jove Tapiador said.

During the summit, rural bank executives shared the challenges they have encountered in their digital transformation journey. They pointed out that most of the available products in the market are from foreign service providers that do not cater to the distinct requirements of small financial institutions in the Philippines.

At the same time, participants stressed the need for collaboration and having a shared and standardized service to achieve improved cost efficiencies.

“We elicited raw and direct answers from rural banks on their pain points: the need for customized solutions around existing processes, sound technical advice based on their requirements, and strong customer support. GoodTech is in the best position to respond to all these challenges,” Tapiador said.

To support their transformation, GoodTech helps rural banks build their own digital channels to expand their markets and gain access to a resilient technology that incorporates compliance and regulation to their process flow. The goal is to create a digital financial ecosystem around rural financial institutions and connect them with underserved markets.

The fintech has two flagship products: GoodLoan, an application designed to enhance the lending business of rural banks through built-in identity verification and compliance checks; and GoodBank, a mobile banking platform that simplifies the deposit account opening process, hassle-free and secure transactions for customers, and built-in electronic checks compliant with electronic banking regulations.

“Every rural bank can be a neobank. Every single one has the potential to be a big player in this wide market. It need not break the bank. You just need to find a good technology that is affordable, accessible and that simply works,” GoodTech Cofounder Rogelio Umali said.